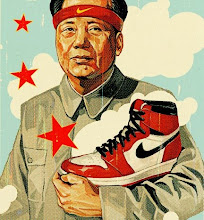

China.

hahahaha. The Shenzhen and Shanghai stock exchanges were down more than 8%. This was the largest drop since the 1997 Asian Financial Crisis. A lot of the stocks fell the daily maximum of 10%. This is crazy. The best performers like the big banks (Bank of China, ICBC, China Merchant's), the Airlines (Air China, China Southern), construction companies, communications companies (China Mobile, China Unicom) were all down huge.

What does that mean?

- The Chinese stock market and economy has a major influence and effect on the global marketplace.

- This shows the uncertainty of the Chinese market

- The year of the boar with double luck and double prosperity ive been hearing about has an interesting start

- The west is really afraid of China. Everyone I know in China knows that this year will be a great year for stocks. With a sudden jolt in the china markets, the US dialed it back and killed their market. While I was watching CNBC channel during it, many people were talking about how this day was unseen in their 20 years of working as a trader.

2 comments:

Call me a hippy liberal, but shouldn't we have expected this? When China carries in excess of $500 billion of US debt in treasury bills, we have yearly tax breaks and a war and no strong sources of GNP to offset cashflow out, did we really expect to have a stable economy? The American economy and debt are dependent on so many foreign countries that if anything happened in one of those countries, we'd feel the repercussions at home immediately, it happened today.

Big surprise. Not really.

fo sho.

However, i don't think today's 400 point drop in the dow was the direct result of any selling of treasury bills by china or a quick de-evaluation of the Chinese yuan (like what happen in Thailand in 1997). It was based on speculation created from fear and uncertainty. That is the only reason why awesome companies with great fundamentals and great earnings fell with everything else today.

Post a Comment